Subtotal ₹0.00

Welcome back! This is Part IV of our “Unlock the Economic Secrets” series. Today, we’re diving into the Logistics Manager’s Index (LMI) and how it can help you get better-paying loads, optimize operations, and maintain consistency in your business.

Reminder: The economy drives the trucking industry.

What is the Logistics Manager’s Index (LMI)?

Imagine you’re driving down the logistics highway, trying to navigate the twists and turns of transportation, warehousing, and inventory management. Wouldn’t it be great to have a GPS that tells you exactly where the roadblocks are and where the fast lanes open up? That’s exactly what the LMI does for you. It’s like a report card showing how busy and costly things are in logistics.

The LMI tracks eight key components, giving you a comprehensive view of the logistics landscape:

- Transportation Capacity:

- What it measures: The amount of available transportation capacity.

- High Capacity: More trucks available, often due to lower demand.

- Low Capacity: Fewer trucks available, indicating higher demand.

- Transportation Utilization:

- What it measures: The level of transportation capacity being used.

- High Utilization: More demand for trucking services.

- Low Utilization: Less demand for trucking services.

- Transportation Prices:

- What it measures: The cost of transportation services.

- High Prices: Increased costs for fuel, labor, and maintenance.

- Low Prices: Decreased costs, potentially due to lower demand.

- Warehousing Capacity:

- What it measures: The amount of available warehousing space.

- High Capacity: More space available, often due to lower demand.

- Low Capacity: Less space available, indicating higher demand.

- Warehousing Utilization:

- What it measures: The occupancy rate of warehousing facilities.

- High Utilization: More demand for storage space.

- Low Utilization: Less demand for storage space.

- Warehousing Prices:

- What it measures: The cost of warehousing services.

- High Prices: Increased costs for storage.

- Low Prices: Decreased costs, potentially due to lower demand.

- Inventory Levels:

- What it measures: The amount of inventory being held.

- High Levels: Strong supply chains or overstock situations.

- Low Levels: Lower inventory, possibly due to high sales or supply chain issues.

- Inventory Costs:

- What it measures: The cost of holding inventory.

- High Costs: Increased expenses for storage and management.

- Low Costs: Decreased expenses, potentially due to lower inventory levels.

9. Logistics Activity:

- What it measures: Overall activity levels in logistics operations, reflecting the combined performance of the eight key components.

- High Activity: Increased movement and transactions, indicating robust demand and economic growth.

- Low Activity: Decreased movement and transactions, suggesting lower demand and potential economic slowdown.

You can explore these components further and view current and past reports at LMI Official Site and LMI Survey.

How to Read the LMI

The LMI score is a composite of the above components. Scores above 50 indicate growth in the logistics sector, while scores below 50 indicate contraction. Each component’s score provides insight into specific areas, like high transportation prices with high utilization indicating strong demand but higher costs.

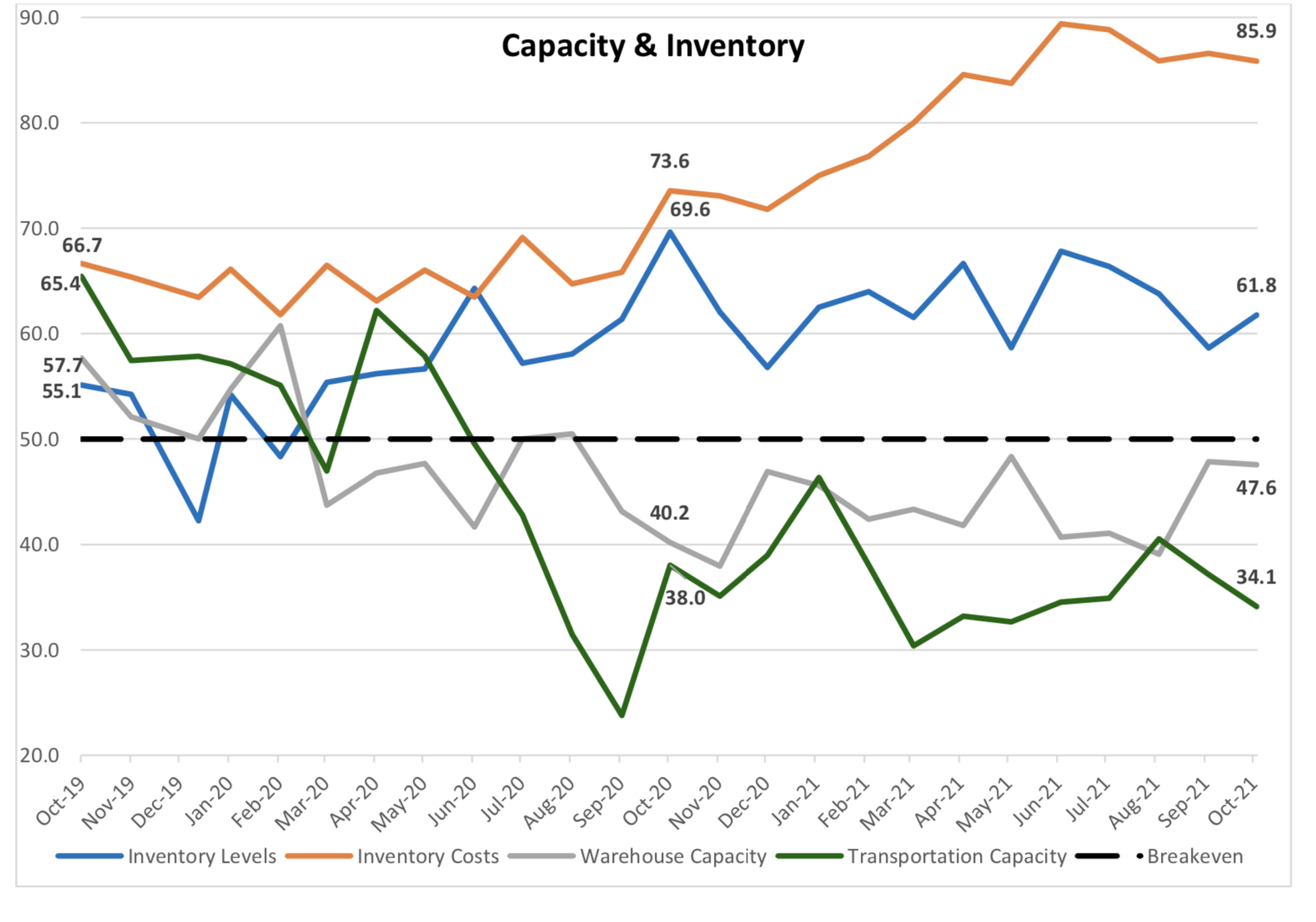

Charts Explaining the LMI

Let’s take a visual tour through the LMI with these charts, so you can see exactly how each component is tracking over time:

- Chart 1: Transportation Capacity This chart tracks the amount of available transportation capacity over time. High capacity indicates more trucks are available, often due to lower demand, while low capacity suggests fewer trucks are available, indicating higher demand.

- Chart 2: Transportation Utilization This chart shows the level of transportation capacity being used. High utilization means more demand for trucking services, while low utilization indicates less demand.

- Chart 3: Transportation Prices This chart reflects the cost of transportation services. High prices indicate increased costs for fuel, labor, and maintenance, while low prices suggest decreased costs, potentially due to lower demand.

- Chart 4: Warehousing Capacity This chart tracks the amount of available warehousing space. High capacity indicates more space available, often due to lower demand, while low capacity suggests less space available, indicating higher demand.

- Chart 5: Warehousing Utilization This chart shows the occupancy rate of warehousing facilities. High utilization means more demand for storage space, while low utilization indicates less demand.

- Chart 6: Warehousing Prices This chart reflects the cost of warehousing services. High prices indicate increased costs for storage, while low prices suggest decreased costs, potentially due to lower demand.

- Chart 7: Inventory Levels This chart represents the amount of inventory being held. High levels indicate strong supply chains or overstock situations, while low levels suggest lower inventory, possibly due to high sales or supply chain issues.

- Chart 8: Inventory Costs This chart shows the cost of holding inventory. High costs indicate increased expenses for storage and management, while low costs suggest decreased expenses, potentially due to lower inventory levels.

- Chart 9: Logistics Activity This chart measures overall activity levels in logistics operations. High activity indicates increased movement and transactions, suggesting robust demand and economic growth, while low activity indicates decreased movement and transactions, suggesting lower demand and potential economic slowdown.

How Does the LMI Impact You?

Real-World Application Examples:

Carriers:

- Scenario: The LMI shows high transportation utilization and high transportation prices.

- Action: Invest in more efficient routing software and negotiate better rates with shippers, knowing that demand is high.

- Outcome: Secure higher-paying loads and improve operational efficiency, leading to increased profits despite higher operating costs.

Brokers:

- Scenario: The LMI indicates low transportation capacity and high warehousing prices.

- Action: Focus on helping clients secure transportation quickly, emphasizing the tight capacity. Negotiate longer-term contracts with warehousing providers to lock in lower rates before they rise further.

- Outcome: Clients appreciate your foresight and efficiency, leading to stronger relationships and more repeat business.

Dispatchers:

- Scenario: The LMI shows high logistics activity and increasing inventory costs.

- Action: Optimize routes to ensure timely deliveries and reduce idle times. Communicate with carriers about potential cost increases and suggest ways to mitigate them.

- Outcome: Improved delivery times and cost savings for clients, enhancing your reputation for reliability and efficiency.

Shippers:

- Scenario: The LMI reports low warehousing utilization and falling inventory levels.

- Action: Increase inventory levels to take advantage of lower storage costs. Negotiate better rates with carriers, as transportation prices are currently stable.

- Outcome: Reduced storage costs and better preparedness for future demand increases, leading to improved supply chain stability.

How Can This Help You Achieve Your Goals?

- Stay Informed: By keeping an eye on the LMI, you can anticipate changes in the market and adjust your strategies accordingly. Whether you’re a carrier, broker, dispatcher, or shipper, staying informed allows you to optimize your operations and make proactive decisions.

- Negotiate Smarter: Use your knowledge of the LMI to negotiate better rates and contracts. When costs are rising, explain why you need higher rates. When costs are falling, use it to offer competitive pricing. This benefits all parties in the logistics chain by ensuring fair and advantageous agreements.

- Build Strong Relationships: Communicate effectively with your clients and partners. Transparency builds trust and can lead to long-term contracts that provide consistent work. Whether you’re a carrier building trust with shippers, a broker with clients, a dispatcher with carriers, or a shipper with suppliers, strong relationships are key to success.

- Plan for the Future: Use periods of lower costs to invest in your business. Upgrade your fleet, invest in new technologies, enhance training, or expand your services to stay ahead of the competition. Forward-thinking strategies benefit everyone in the logistics ecosystem, ensuring preparedness for market fluctuations.

Conclusion

The LMI is an essential tool for anyone in the logistics industry. It provides valuable insights that can help you stay competitive, make informed decisions, and ultimately achieve your business goals. By understanding and utilizing the LMI, you can navigate the logistics landscape more effectively, ensuring your operations are optimized and your strategies are aligned with market trends.

Whether you’re a carrier looking for better-paying loads, a broker aiming to secure advantageous contracts, a dispatcher striving for efficiency, or a shipper wanting to stabilize your supply chain, the LMI offers the data you need to make smart, strategic choices.

Stay tuned!

Stay tuned for our next blog post in the “Unlock the Economic Secrets” series, where we’ll explore another key economic indicator to help you make better business decisions. Together, we’ll continue to unlock the secrets of the economy and harness that knowledge to drive success in the logistics industry.

For more detailed information on the LMI and to view current data, visit: