Subtotal ₹0.00

This is part II of our series on understanding economic indicators and their impact on the trucking industry. Our first post introduced the series and discussed the importance of the following indicators: CPI, PPI, LMI, interest rate, trucking authority entries and exits. Today, we’re diving into the Consumer Price Index (CPI) and its relevance for carriers, brokers, dispatchers, shippers, and those interested in entering the industry.

We will identify what the CPI is, how it adjusts, its impact on consumers, businesses and investors (they are called the economy), how they react, its ultimate effects on the trucking industry, and strategies you can take in your business that can help you thrive.

In our Bonus section, find out how the CPI impacts the trucking industry, including freight Brokering. Sign up to ELEVATE for free and visit the ‘Audios, Videos and more…’ section.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the average change over time in the prices paid by consumers for a basket of goods and services. It’s like a thermometer for the economy, indicating whether prices are rising or falling.

How is the CPI Measured?

-

- Basket of Goods: Imagine a shopping basket filled with things people commonly buy, such as bread, milk, and gasoline. The CPI tracks the prices of these items.

-

- Price Comparison: Each month, the prices of the items in the basket are checked and compared to the prices from a previous month (MoM) or year (YoY).

-

- Calculation: The change in prices is averaged and turned into a percentage. For example, if the CPI is 2%, it means prices have increased by 2% compared to a previous time period.

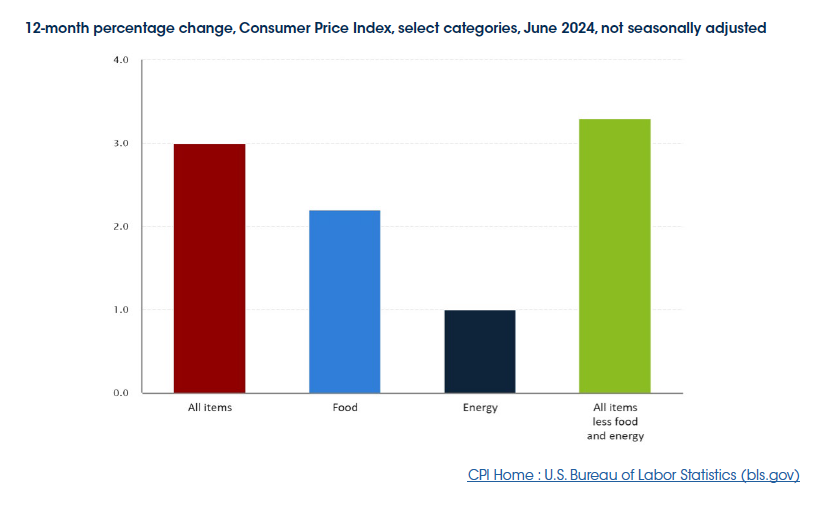

Current Data (June 2024):

-

- Headline inflation rate: +3.0% YoY

-

- Includes all items

-

- Headline inflation rate: +3.0% YoY

-

- Core inflation rate: +3.3% YOY

-

- All items less the volatility of food and energy

-

- Core inflation rate: +3.3% YOY

-

- Food: +2.2% YoY

- Energy: +1.0% YoY

- Headline Inflation rate: -0.1% MoM

How Often is the CPI Measured? The CPI is measured every month by the Bureau of Labor Statistics (BLS).

Why is the CPI Measured? The CPI is measured to:

-

- Track Inflation: It helps us understand how quickly prices are rising (inflation) or falling (deflation).

-

- Adjust Wages: Many employers use the CPI to adjust salaries to keep up with inflation.

-

- Economic Policy: Policymakers use the CPI to make important economic decisions, like setting interest rates.

For more detailed information, visit the Bureau of Labor Statistics’ About CPI page.

Why We Need to Know About the CPI

Tracking Inflation

-

- Inflation Measurement: The CPI is a primary tool for measuring inflation, which is the rate at which the general level of prices for goods and services is rising. Keeping track of inflation helps individuals and businesses understand how their purchasing power is changing over time.

-

- Cost of Living Adjustments: Many wages, pensions, and government benefits are adjusted based on the CPI to ensure that people can maintain their standard of living despite rising prices.

Economic Planning and Policy Making

-

- Government Decisions: Policymakers use the CPI to make informed decisions about economic policy. For example, the Federal Reserve may adjust interest rates based on CPI data to control inflation.

-

- Budgeting and Planning: Both government and private sectors use CPI data for budgeting and financial planning. Knowing how prices are trending helps in forecasting future expenses and revenues.

Business Decisions

-

- Pricing Strategies: Businesses monitor the CPI to adjust their pricing strategies. Understanding how prices for raw materials and goods are changing helps businesses set competitive prices while maintaining profitability.

-

- Contract Adjustments: Long-term contracts often include clauses that adjust payments based on changes in the CPI to account for inflation.

Personal Financial Management

-

- Budgeting: For individuals, knowing the CPI helps in planning personal budgets. If the CPI indicates rising prices, consumers might need to adjust their spending to ensure they can cover essential expenses.

-

- Investment Decisions: Investors use CPI data to make informed decisions. For example, rising inflation might lead investors to seek assets that traditionally perform well in inflationary environments, such as real estate or commodities.

Understanding Economic Health

-

- Economic Indicator: The CPI is a key indicator of the overall economic health. A steadily rising CPI might indicate a growing economy, whereas a rapidly increasing CPI could signal overheating, and a declining CPI might suggest deflation and economic slowdown.

-

- Consumer Confidence: Changes in the CPI can influence consumer confidence. If consumers see that prices are rising rapidly, they might reduce spending, which can impact economic growth.

Real World Applications: Impact on Consumers and Businesses

Impact on Consumers

-

- Budgeting and Spending Habits

-

- Rising CPI: When the CPI rises, it indicates that the cost of living is increasing. Consumers often react by adjusting their budgets to prioritize essential goods and services, such as food and housing. Discretionary spending on items like dining out, entertainment, and luxury goods typically decreases.

-

- Falling CPI: A falling CPI suggests that prices are decreasing, which can lead to increased consumer spending as people feel they have more purchasing power. However, if the CPI falls too quickly, it might indicate deflation, causing consumers to delay purchases in anticipation of even lower prices.

-

- Wage Adjustments

-

- Rising CPI: Employers may raise wages to keep up with inflation, ensuring that employees can maintain their purchasing power.

-

- Falling CPI: If the CPI falls, there is less pressure on employers to increase wages. In some cases, wages might even be frozen or reduced, especially if deflation is severe and impacts company revenues.

-

- Budgeting and Spending Habits

Impact on Small to Large Businesses

-

- Pricing Strategies

-

-

-

- Rising CPI: Businesses often pass on increased costs to consumers through higher prices. Small businesses might struggle more with this as they have less pricing power compared to larger corporations.

-

-

-

-

-

- Falling CPI: When the CPI falls, businesses may lower prices to attract customers or to stay competitive. This can benefit consumers but can squeeze profit margins for businesses.

-

- Inventory Management

-

-

-

-

- Rising CPI: Businesses may accelerate purchasing and stockpiling inventory to avoid future price increases.

- Falling CPI: Companies might reduce inventory levels to avoid holding goods that could decrease in value.

-

-

3. Investment Decisions

-

-

-

- Rising CPI: Higher inflation can lead businesses to invest more in tangible assets, such as real estate or commodities, which tend to retain value better than cash during inflationary periods.

- Falling CPI: In a deflationary environment, businesses might hold off on major investments due to uncertainty about future price trends and demand. Cash conservation becomes a priority to navigate through potential economic downturns.

-

-

Bonus

How the CPI Applies to the Trucking Industry

The CPI has a significant impact on the trucking industry, influencing costs, pricing strategies, client relationships, and business decisions. Here’s how a trucking company can be impacted and how they might react to changes in the CPI.