Subtotal ₹0.00

FR8Connect | ELEVATE | Water Drop™ | FR8Pulse™ – EXCLUSIVE

1. Follow the Oil: The Lifeblood of Manufacturing

China’s massive manufacturing juggernaut doesn’t just rely on labor and factories—it depends on oil. About 8–10% of Chinese crude oil comes from Iran, smuggled through a “ghost fleet,” relabeled via nations like Malaysia or Oman to dodge U.S. sanctions WJS+Mint. That Iranian oil is both the fuel for factory generators and the feedstock for petrochemicals—ethylene, benzene, propylene—which are used to make plastics, synthetic rubbers, adhesives, electronics, tires, pharmaceuticals, and more. From ballpoint pens to iPhones, Iranian oil helps produce most goods exported from China to the U.S.

China is one of the world’s top manufacturers, especially for consumer goods, electronics, pharma, plastics, and textiles. Here’s how deeply U.S. goods are tied to Chinese production:

✅ Commonly Imported from China

- Adhesive

- Air mattresses

- Awnings

- Backpacks

- Ballpoint pens

- Balloons

- Bandages

- Beach umbrellas

- Cameras

- Candles

- Cell phones

- Clothing

- Coffee makers

- Combs

- Computer gear

- Crayons

- Curtains

- Deodorant

- Detergent

- Dish soap

- Electric blankets

- Eyeglasses

- Hair care items

- House paint

- Ice buckets/trays

- iPhones/iPads

- Laptops

- Lipstick

- Loudspeakers

- Luggage

- Model cars

- Mops

- Motorcycle helmets

- Nail polish

- Nylon rope

- Paint supplies

- Perfume

- Petroleum jelly

- Plastic toys

- Purses

- Shampoo

- Shoe polish

- Shower curtains

- Sunglasses

- Surf boards

- Tents

- Tires

- Toothpaste

- Trash bags

- TV cabinets

- Upholstery

- Vitamin capsules

- Yarn

⚠️ Partially Sourced or Raw Materials

- Ammonia

- Antifreeze

- Antihistamines

- Aspirin

- Cortisone

- Antiseptics

- Denture adhesives

- Dyes

- Enamel

- Epoxy paint

- Fertilizers

- Glue

- Glycerin

- Rubbing alcohol

🤖 Industrial/Niche Products

- Boats / Kayaks

- Dashboards

- Fishing boots/lures

- Food preservatives

- Golf gear

- Guitar strings

- Hearing aids

- Heart valves (some)

- Oil filters

- Refrigerants

- Roofing

- Tubing

- Water pipes

- Wind turbine blades

❌ Rare or Not Typically from China

- Spacesuits

- High-grade heart valves

- Domestic propane

- Some U.S.-made chemicals

🔍 Summary: Over 80% of the listed goods either come from China, are assembled in China, or use Chinese-made parts or chemicals.

2. Supply Chain Tightrope: Sanctions vs. Smuggling

Under U.S. policy, Iran remains heavily sanctioned, banning most oil exports. Yet China buys roughly 1.4 million barrels per day, over 90% of Iran’s crude output, using cover channels WJS+Mint. This underground trade gives China a cheap energy input—Iranian crude is $2–11/barrel cheaper WJS+Mint—but risks deepening global dependency.

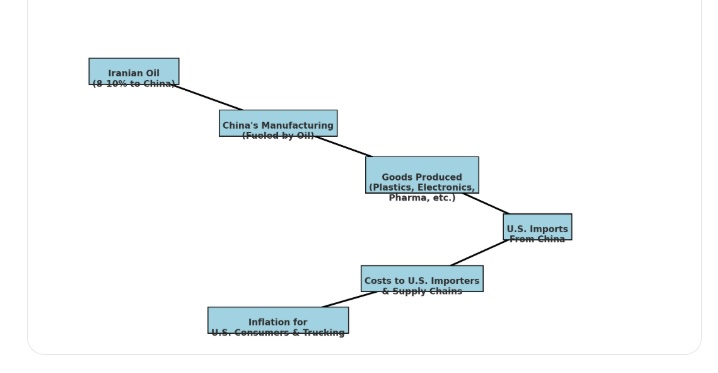

The diagram below called, “Follow the Oil: How Iran Impacts Your Wallet”, shows the flow of Iranian oil: how it gets to China, and ultimately to the U.S. via throught he production of imported products.

Iranian oil may seem far away—but it has everything to do with your wallet, your truck, and your freight.

Here’s the connection in simple terms:

- Iran secretly sells millions of barrels of oil to China — even under U.S. sanctions.

- China uses that oil in two ways:

- ➡️ To power its factories

- ➡️ To turn it into plastics, chemicals, and materials

- China manufactures goods using that oil — from toys, electronics, and furniture to tires, medicine, and packaging.

- Those goods are shipped to the U.S. — and make up a huge part of what we import and transport.

So what happens if Iran’s oil gets blocked or bombed?

- ⛽ China’s production costs rise

- 📦 U.S. imports cost more

- 🚚 Truck parts, packaging, and products inflate

- 💰 Consumers feel it at checkout — and truckers feel it in fuel and repair bills

Even if the U.S. stays out of war, we’re already in the supply chain.

This is why your fuel prices rise, your freight slows, and why FR8Connect’s FR8Pulse™ and Water Drop™ help you stay prepared—not just reactive.

3. Escalations Ignite Price Pressures

Now the Middle East is burning. Israel’s recent airstrikes on Iranian nuclear and oil facilities have already pushed oil prices up 7–11% in days—a single escalation rattled markets The Washington Post. Iran even threatened to close the Strait of Hormuz, which alone carries ~20% of global oil. The threat? Oil prices could surge past $100150/barrel Wikipedia.

4. The Global Dominoes: War → Oil → Inflation

Here’s how the ripple flows:

- Conflict halts or threatens Iranian crude shipments → China loses cheap oil feedstock.

- Chinese refiners are forced to buy more expensive OPEC crude → $ input-cost rises.

- That hits the cost of Chinese exports across electronics, plastics, auto parts, packaging.

- U.S. importers pay (or pass it on); trucking lanes move fewer but pricier goods.

- American consumer prices inflate, on top of rising diesel and freight costs.

5. Tariff Tightrope & Policy Ping-Pong

Just as oil supply is strained, the U.S. may bring back high tariffs on China in August WSJ. The Biden-Trump interim deal paused tariffs (~30%), but that peace is fragile Moneyweek. Reinstated duties, combined with costlier oil, equals a double punch to U.S. businesses and consumers.

Federal Reserve Chair Powell confirms that tariff-driven price hikes are hitting goods right now Reuters. Meanwhile, the Port of Los Angeles saw a 9% drop in imports in May amid 145% tariffs Reuters.

6. Trump’s Black‑Widow Web

Donald Trump has tangled the U.S. in a sprawling, sticky web of global conflict:

- Israel–Iran war: U.S. may directly intervene, risking oil disruption and inflation.

- Iran–China pact: China depends on Iran for cheap feedstock; sanctions enforcement risks destabilizing U.S.–China trade.

- Russia–Ukraine war: Russia backs Iran and China; U.S. aids Ukraine, scattering global alliances.

- Trade war: U.S.–China tensions fueled tariffs, but China’s resilience and teapot refineries blunt their impact Reuters WSJ+Mint The Islamabad Telegraph.

- U.S.–Canada friction: As the U.S. weaponizes trade policy, even traditional allies feel the strain.

The result: Trump’s America‑First posture has collided with world complexity, with unintended consequences in oil, trade, and inflation.

7. What Trump Must Think About Now

To untangle this web, President Trump must:

- Decouple sanctions from energy security: Target war without cutting global oil flows.

- Coordinate with allies & adversaries: Seek international oil buffers (Saudi, UAE) before conflict peaks.

- Delay tariffs: Pausing in August would ease inflation while geopolitical pressures mount.

- Rebuild diplomacy: Strengthening U.S.–China and U.S.–Canada relations is vital for supply‑chain stability.

- Communicate consequences: Americans deserve to know that Middle East strategy isn’t isolated—it drives prices at every checkout.

8. Why the Trucking and Freight Industry Should Care

Freight pros, brokers, and carriers need to understand this full picture:

- Diesel girds your fleet; gasoline informs your fuel budgets.

- Import flows feed your freight; reduced China imports = less cargo for your trucks.

- Product shortages and price spikes impact demand and negotiating power.

- Tariffs + oil shocks compress margins at every level—from packing the truck to paying the driver.

9. In Conclusion

🧭 Summary:

- Iran’s oil is absolutely vital to China’s low-cost manufacturing

- Disrupting that supply = costs rise for U.S. imports

- Result = inflation in the U.S., especially in freight, retail, and tools

- Trucking industry must prepare for fuel price swings + freight shifts

From Iranian oil smuggled into Chinese refineries, to goods shipped into U.S. ports, to prices paid at national checkout lines—this is the hidden pipeline of influence.

Trump’s involvement in Israel‑Iran escalation, simultaneous with potential tariff hikes and fractured alliances, has created a Black‑Widow’s Web that entangles global trade, energy, and consumer costs.

It’s not enough to act boldly; leadership means acting wisely—strategically coordinating energy policy, diplomacy, and trade to protect American families and businesses.